Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-05-21 • Updated

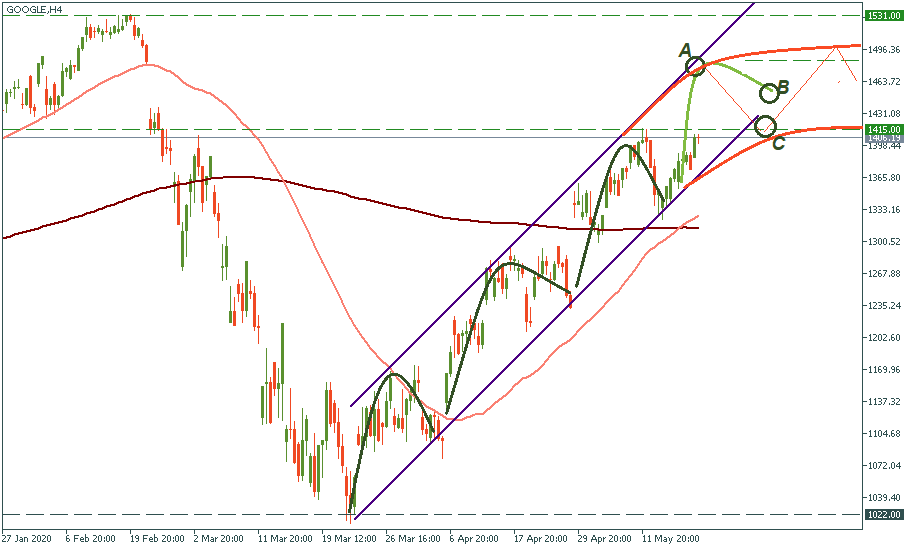

On the H4 chart, we see Google stock on the path of recovery. It is almost there, but the question is whether the pace of recovery will remain the same, completing the V-like overall chart formation, or it will slow down coming closer to the resistance of $1,531. Let’s see how we can find that out.

In the case of steady growth consistent with the trajectory it has been showing after bottoming out in March, the price will make another leap to the higher boundary of the movement channel, which will come to point A roughly corresponding to $1,490. After that, if the inner logic of the movement remains, the price will bounce down to point B – that’s where the lower boundary of the channel will be. This will complete the fourth wave of the upward movement.

Otherwise, the stock will slow down the closer it gets to the full recovery mark of $1,531. In the weakening growth scenario, the stock may come to point A or slip lower to eventually get into a bearish move crossing the lower border of the initial movement channel. That’s how point C may be reached, bending the overall trajectory range closer to the horizon. After that, the stock will anyway rise again, but probably to $1,496 or even below.

Which scenario will it be? Make your bets, we will discover soon enough.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!