The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

2019-11-11 • Updated

The fall of the Turkish lira has been continuing for a long time. For the first time, the Turkish currency significantly plunged in July 2016 after the coup attempt. Foreign investment flows strongly declined and the rate of the lira fell against all major currencies as the government started repression against its opponents and continued the war against Kurdish militants in Syria and Iraq.

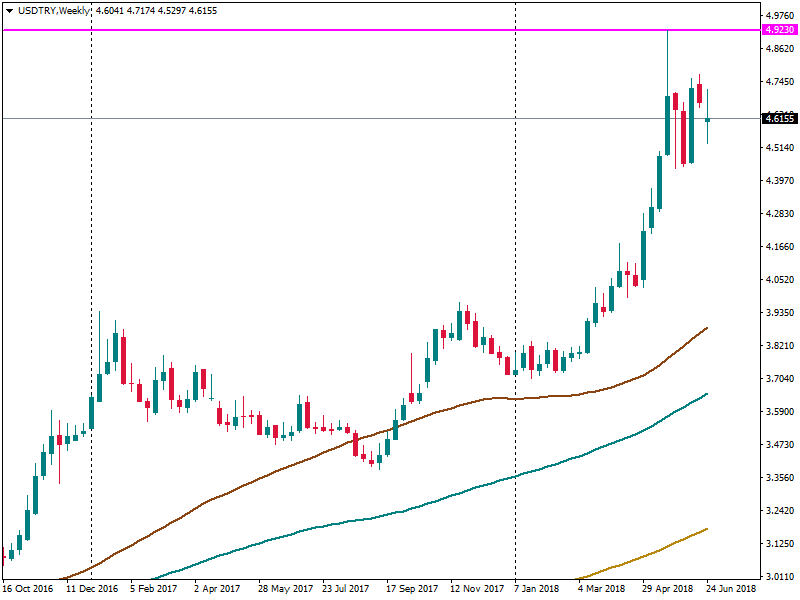

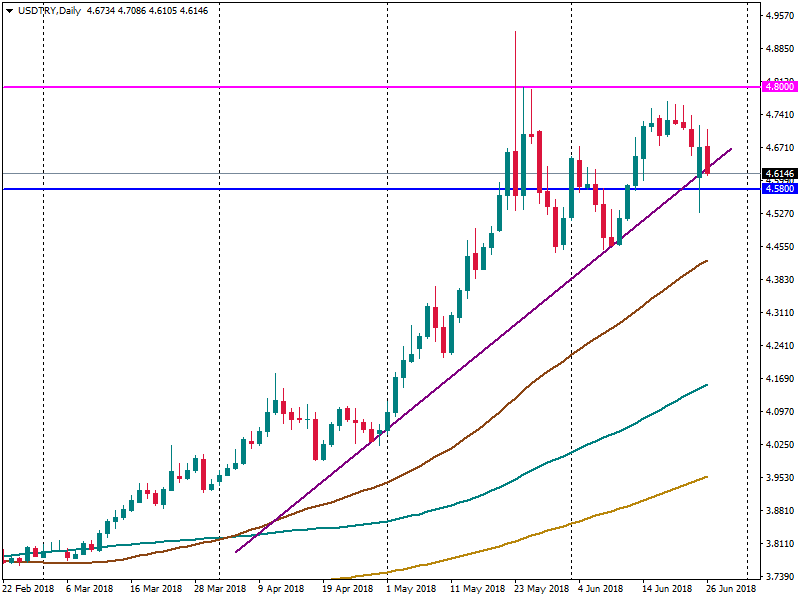

This year the Turkish lira has depreciated by 20% against the USD. In May, the currency fell to the record low in the history. USD/TRY reached the level of 4.9230. The plunge was caused by threatening policy of the Turkish president. Mr. Erdogan insisted on low interest rates and tighter control of the monetary policy.

However, to prevent the further fall of the currency, the central bank lifted the interest rate two times, in May and June. As a result, the interest rate increased from 8% to 17.75%. But it didn’t support the lira a lot.

Up to now, the Turkish currency has been strengthening against the USD because of the victory of the acting Turkish President Mr. Erdogan in the election. Moreover, the victory positively affected other Turkish markets as a risk of the second round of the election disappeared.

But should traders be optimistic about the further rise?

According to analysts, despite the fact that the lira managed to recover after the election, threats of the further fall still exist. Experts say the strengthening of the lira is more likely only in a short-term as the strong plunge was caused not only by political issues but the total sell-off of emerging markets.

Moreover, the Turkish economy suffers a lot. The lira depreciates, stock indices fall, inflation is at high levels, and the budget suffers from the deficit. Before the election, the government stimulated the economic growth. Taxes were cut, the country provided advance payments for loans issued by Turkish companies. Also, the government allocated funds in the amount of $400 per year for every pensioner, granted tax advantages for buyers of real estate. As a result, the deficit of the budget became bigger by 37% than a year ago.

However, the major threat for the lira is the future policy of the Turkish president. If he continues to control the interest rates, the currency will plunge further. Moreover, assignments of government’s members will affect the course as well. Traders will look whether market-oriented governors will keep their positions or they will be fired.

Up to now, the USD/TRY has been moving down. However, as we said above, the Turkish lira is anticipated to fall further, so the pair may return to the previous highs. We recommend you to follow the policy of Mr. Erdogan. If he eases its approach to the regulation of the monetary policy, the lira will have chances to strengthen, otherwise, the further plunge is anticipated.

Making a conclusion, we can say that the lira is anticipated to stay highly volatile in the near future. Although the central bank had raised the interest rate, it doesn’t persuade that the course of the monetary policy has changed. The key to the future rate of the lira is the policy of Mr. Erdogan.

The EU plans to intervene in markets directly to curb rising energy costs, threatening to push the Euro area's economy into a deep recession.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Yes, oil prices are burning right now, and inflation is getting hotter along with it worldwide. However, the oil's bullish momentum is under threat.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!