Hey folks, it’s a wrap to yet another month in the 2023 calendar, and I’m guessing you know what that means - time for another episode in the “What To Trade” series. For December, I will be mapping out trade more cautiously as the market volatility often drops massively, causing the markets to slow down drastically. Having said that, these are my top three trade ideas for December, for the time being.

USDJPY - D1 Timeframe

USDJPY on the Daily timeframe can be seen reacting from the confluence of the 100-Day moving average and the drop-base-rally demand zone. This confluence in conjunction with the bullish array of the moving averages indicates a likely bullish outcome - which is my sentiment in this case.

Analyst’s Expectations:

Direction: Bullish

Target: 150.153

Invalidation: 146.482

AUDJPY - D1 Timeframe

AUDJPY on the daily timeframe has already been rejected from the supply zone for a second time, this time also breaking minor structure on the H4 timeframe. In this case, my initial target is set at the intersection of the demand zone, 50-period moving average, and the trendline support.

Analyst’s Expectations:

Direction: Bearish

Target: 96.500

Invalidation: 98.344

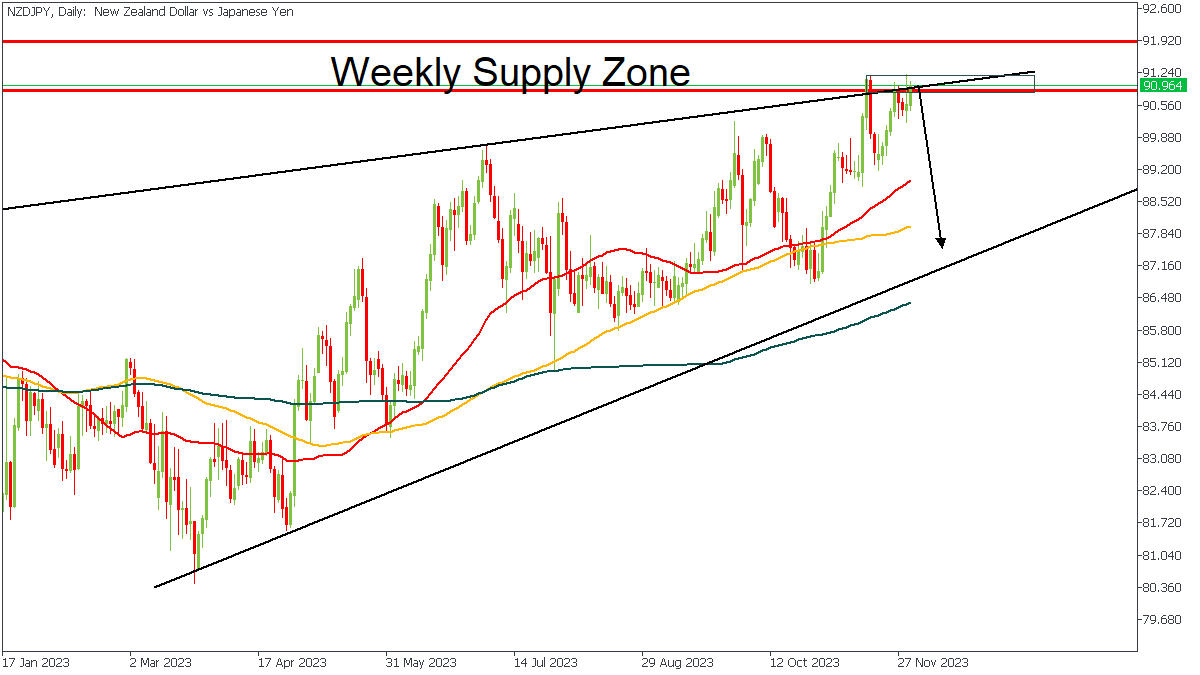

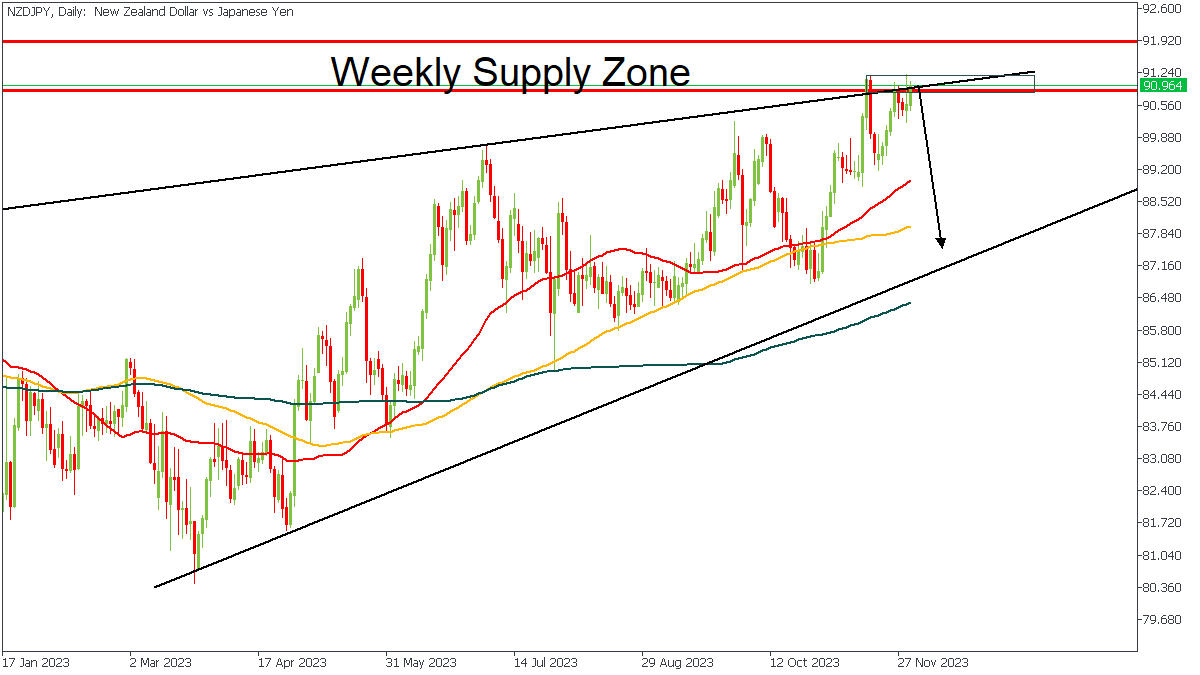

NZDJPY - D1 Timeframe

NZDJPY is currently trading within the supply zone on the weekly timeframe, and has already been rejected once from the zone. At the moment, there is also a resistance trendline intersecting the weekly supply, increasing the likelihood of a bearish momentum from the current supply zone.

Analyst’s Expectations:

Direction: Bearish

Target: 87.922

Invalidation: 92.011

CONCLUSION

The trading of CFDs comes at a risk. To succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.